by @goodalexander

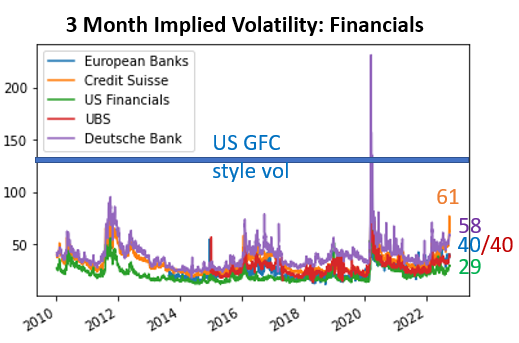

Credit Suisse. Below I will summarize what has happened and what I think the implications are. 1/ Credit Suisse options price an explosive equity move over the next 3 months. Implied vol of 61 at decade highs imply moves 2x US financials. Bonds and CDS paint a similar story.

2/ CDS are a bit hard to understand, so instead I’ll focus on the bonds. The 2025 Credit Suisse bonds pictured below trade at 6.4%. Compare this, for example to Ukraine 2025 debt trading at 67%. Talking about Ukrainian debt default makes sense. CS debt default – less so.

5/ CS results have 4 levers. A] a Swiss bank and wealth arm serving rich folk. Doing great B] an investment bank that’s losing share with no prime brokerage due to Bill Hwang’s blow up C] big legal liability and fines from B D] A flailing fund distribution suite, “AllFunds”

10/ It’s probably worth pointing out here that the equities group (Prime Services) that blew up CS to the tune of $5.5 billion (over 1/2 of the bank’s current market cap) servicing Bill Hwang – is separate from the derivatives group the bank plans on spinning off in Late October

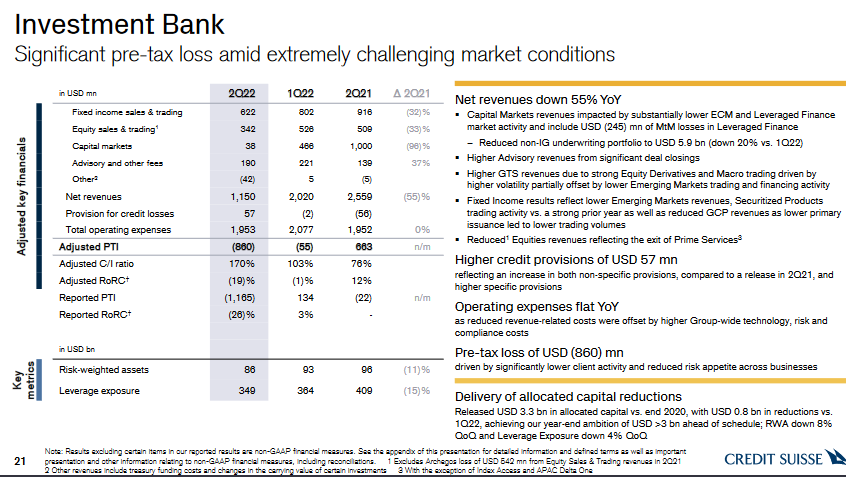

11/ There are 2 quite scary things about the outlook for CS ibank when you delve a bit. First: the -32% comp on Fixed Income pnl was due to slowing bond issuance. Citrix & other deal pulls are crushing issuance volumes with Sept’s $75b of deals 50% below expects

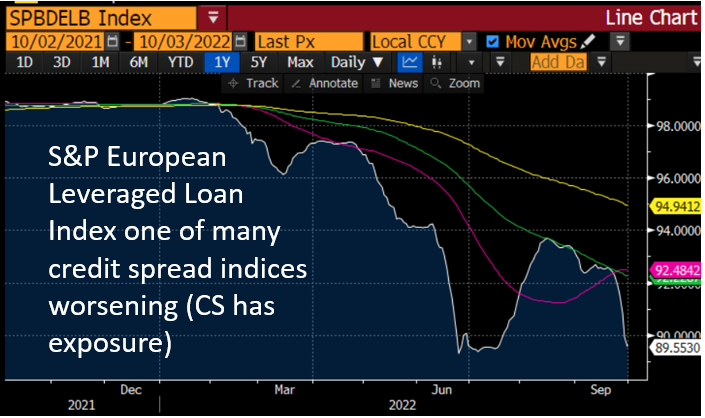

12/ Second – when management talks about the “credit spread mark to market losses” of $245m they said “the majority of these losses are unrealized”. And then they get a follow up question where it seems like the plan was to hope credit spreads narrow. That hasn’t happened.

13/ the FT reported that the bank’s plan for dealing with the LevFin losses is to package them into some kind of “bad bank” separate from other assets in the investment bank and let investors bid on that separately, presumably at a steep discount.

14/ And the last time they talked about the LevFin losses, the Citrix deal hadn’t even happened yet. CS was involved in a block sale for Citrix bonds which faltered leaving banks holding a $6.5 b bag they lost $600m on. And since then, the $4b Brightspeed deal has also died

15/ At this point it should probably be clear CS has a culture problem. Not to mention legal problems of $1b+ in 1H 2022. Notably, the current lawsuit from a Georgian prime minister deal with inept / dishonest foreign wealth practices not trading.

16/ The ex prime minister of Georgia, Ivanishvili, had a CS banker Patrice Lescaudron who lost his $, covered it up, got convicted of fraud in 2018, sent to jail, released then killed himself after being released in 2020. The NYT reported this is a pattern

17/ The war on Ukraine & US sanctions will add scrutiny on ‘cover banking operations’ at CS. And doubling down on the Chinese market is likely quite risky. Due to collapsing foreign inflows, on Friday the Chinese regulator announced a crackdown on outflows

18/ That leaves a pretty nasty set up into the Q3 ‘plan announcement’ later this month. The leveraged finance group probably lost even more $. And other banks won’t have risk appetite for a structured products group given what’s happening in mortgages/ other credit markets

19/ The giant legal liabilities management tries to avoid discussing are in fact a structural part of Credit Suisse’s business model – and doubling down on Chinese wealth mgmt could anger both CCP officials as well as US regulators into an extremely sensitive time (Xi’s 3rd term)

20/ am I jumping up and down to ‘fade the CS panic’? no Is it Lehman? no. Lehman was the cause, CS is a casualty Could the stock go to zero bc of bond market liquidity issues compounding its asset sale plan? yes – which is probably relevant to ‘financial stability’ narrative